Things about Transaction Advisory Services

The 7-Second Trick For Transaction Advisory Services

Table of ContentsThe 8-Minute Rule for Transaction Advisory ServicesLittle Known Questions About Transaction Advisory Services.Excitement About Transaction Advisory ServicesThe Buzz on Transaction Advisory ServicesOur Transaction Advisory Services Statements

And figure that Big 4 companies could provide much easier paths right into higher-paying work in money, consulting, and related areas. I could go on, yet you get the concept. The point is, everyone arguments the values of these work, but there's still a great deal of confusion over what "Deal Solutions" suggests.

By comparison, Large 4 TS teams: Work with (e.g., when a prospective purchaser is conducting due diligence, or when a deal is closing and the customer needs to incorporate the company and re-value the vendor's Annual report). Are with costs that are not linked to the offer shutting successfully. Gain charges per interaction someplace in the, which is less than what investment financial institutions make also on "little bargains" (yet the collection chance is also much higher).

In comparison to these three teams, the and teams are a lot closer to investment banking. The Business Finance group at the majority of Huge 4 companies is an inner investment financial institution that executes entire M&A bargains from beginning to end. The experience is more relevant for IB/PE duties, however these CF teams also often tend to service smaller sized bargains than the FDD teams.

How Transaction Advisory Services can Save You Time, Stress, and Money.

, but they'll concentrate extra on accounting and valuation and much less on subjects like LBO modeling., and "accounting professional only" subjects like trial balances and how to walk with events using debits and debts rather than monetary declaration adjustments.

that show just how both metrics have transformed based upon products, channels, and clients. to evaluate the accuracy of administration's past forecasts., consisting of aging, stock by item, ordinary levels, and provisions. to figure out whether they're totally fictional or somewhat credible. Professionals in the TS/ FDD groups may likewise interview administration concerning whatever above, and they'll create a detailed record with their searchings for at the end of the process.

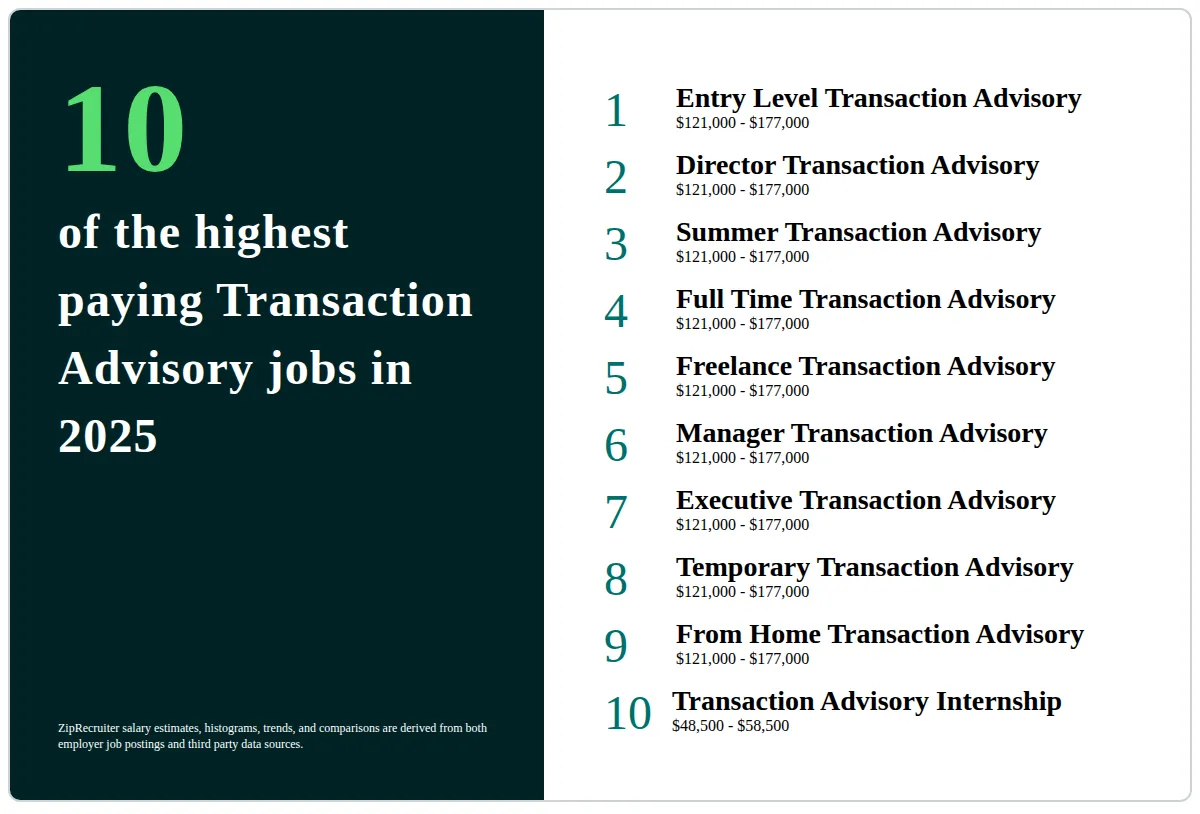

The power structure in Deal Providers differs a bit from the ones in investment banking (Transaction Advisory Services) and private equity professions, and the basic shape looks like this: The entry-level duty, where you do a lot of data and financial evaluation (2 years for a promo from here). The following level up; similar job, however you obtain the even more interesting little bits (3 years for a promo).

Particularly, it's hard to get advertised past the Supervisor level since few individuals leave the job at that phase, and you need to start revealing proof of your capability to generate income to breakthrough. Let's begin with the hours and way of living considering that those are simpler to describe:. There are periodic late nights and weekend break job, however absolutely nothing like the frenzied nature of investment banking.

The Main Principles Of Transaction Advisory Services

There are cost-of-living adjustments, so expect lower payment if you're in a less expensive place outside major financial. For all positions except Partner, the base pay comprises the bulk of the complete compensation; the year-end bonus offer may be a max of 30% of your base pay. Usually, the finest means to increase your incomes is to change to a various company and bargain for a greater income and incentive.

At this phase, you ought to just remain and make a run for a Partner-level function. If you desire to leave, maybe relocate to a client and execute their appraisals and due persistance in-house.

The major problem is that since: You usually need to sign up with an additional Large 4 team, such as audit, and job there for a couple of years and after that relocate into TS, work there for a few years and after browse this site that move into IB. And there's still no warranty of winning this IB function because it depends on your region, customers, and the working with market at the time.

Get This Report about Transaction Advisory Services

Longer-term, there is also some risk of and due to the fact that assessing a firm's historical economic info is not precisely rocket scientific research. Yes, people will always require to be involved, yet with advanced modern technology, reduced headcounts can possibly sustain client involvements. That said, the Transaction Services group beats audit in terms of pay, job, and leave chances.

If you liked this article, you may be thinking about analysis. (Transaction Advisory Services)

Transaction Advisory Services - Questions

For Colorado & Illinois Applicants: We are pleased to offer qualified team a robust benefits package. Qualification and payment demands for some of these benefits differ based upon the variety of hours team job weekly. Highlights include health, dental, vision, disability and life insurance policy. These conventional offerings work great site on the first of the month following your start date.

A Pension is likewise readily available for qualified management and paraprofessional staff. A discretionary perk strategy is readily available for qualified personnel. Plante Moran also offers Interns and Service providers the alternative to elect health and wellness insurance coverage under our contingent staff clinical strategy since the 1st of the month adhering to 60 days of work in enhancement to restricted paid time sick time.

Consider it as being the economic physician for companies undergoing significant surgery. They consider the firm's wellness, figure out the risks, and assist see to it the entire thing goes efficiently. It's not simply regarding crunching numbers; it's additionally about comprehending the company, the market, and the people entailed.